41 how to find the coupon payment

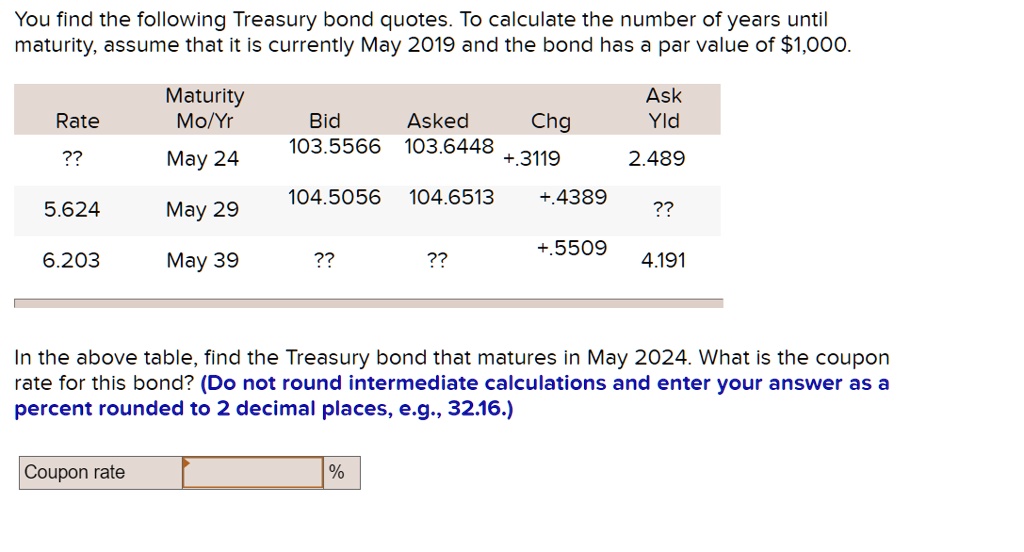

How do I Calculate Zero Coupon Bond Yield? - Smart Capital Mind The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. The yield is thus given by y = (Face ... What Is a Coupon Payment? - Smart Capital Mind A coupon payment often determines the yield of a bond at any given time. Typically dependent on the coupon rate or interest rate of a bond, a coupon payment refers to a payment made to the holder of a bond. A bond is essentially a loan made by one person or agency to another. When someone buys a bond, regardless of whether it is from a company ...

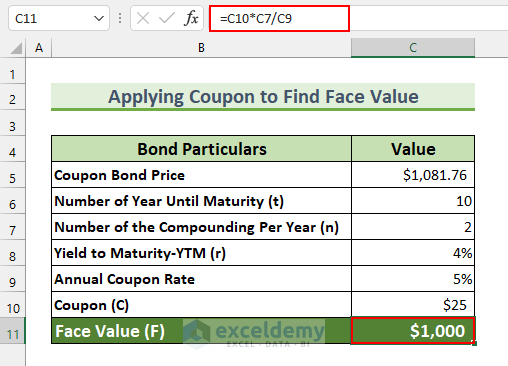

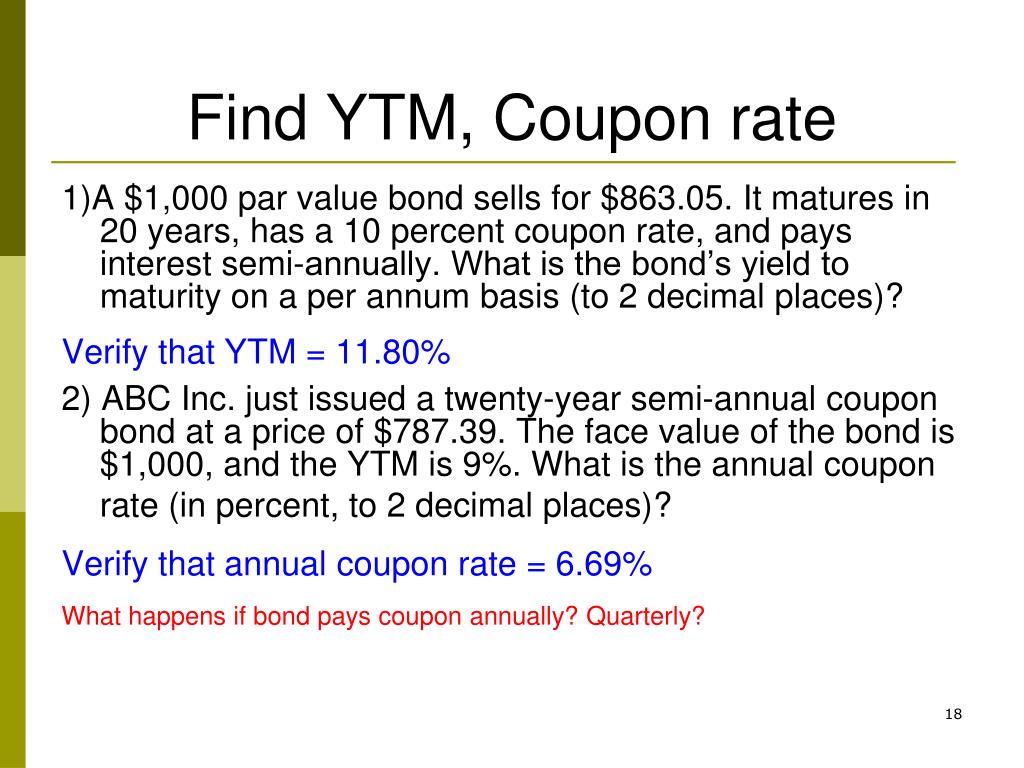

How to Calculate the Bond Duration (example included) Therefore, for our example, m = 2. Here is a summary of all the components that can be used to calculate Macaulay duration: m = Number of payments per period = 2. YTM = Yield to Maturity = 8% or 0.08. PV = Bond price = 963.7. FV = Bond face value = 1000. C = Coupon rate = 6% or 0.06. Additionally, since the bond matures in 2 years, then for ...

How to find the coupon payment

Coupon Barcode Decoding - Understanding Barcodes on Coupons For example, if dd=50, the coupon is for 50 cents off. There are a few exceptions. 01 - free. 14 - b1g1 free. 16 - b2g1 free. 19 - b3g1 free. 02 - b4g1 free. If you still aren't sure how to decode or you have a more complicated coupon, then look for a coupon barcode decoder. You can find out which products apply to certain coupons. How to Calculate the Price of a Bond With Semiannual Coupon Interest ... Multiplying the results by the eight coupon payments and the one final face-value payment discounts them to $24.27, $23.56, $22.88, $22.21, $21.57, $20.94, $20.33, $19.74 and $789.41, respectively. Summing and Pricing. Add the results of the previous calculations to achieve a total present value. Concluding the example, adding the present ... What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

How to find the coupon payment. How To Find Coupon Rate Of A Bond On Financial Calculator Divide the coupon payment amount by the face value. Multiply the result by 100 to get the percentage. For example, you have a $1,000 bond with a $50 coupon payment. To calculate the coupon rate, you would divide $50 by $1,000 and multiply by 100. The result is 5%, which means the bond pays 5% interest per year. Conclusion Coupon Payment | Definition, Formula, Calculator & Example Coupon payment for a period can be calculated using the following formula: Where F is the face value of the bond, c is the annual coupon rate and n represents the number of payments per year. Coupon Payment Calculator Example Walmart Stores Inc. has 3 million, $1,000 par value bonds payable due on 15th August 2037. Find the coupon date of a bond 1 It will pay periodic coupons starting from the issue date. You can also work backwards from the maturity date. In your example the bond matures on March 6, 2022 and pays interest annually (although I find conflicting data from other sites) so it pays interest every March 6th (plus or minus a few days depending on what the prospectus says). Coupon Rate: Formula and Bond Yield Calculator How to Calculate the Coupon Rate — The Coupon Rate is multiplied by the par value of a bond to determine the annual coupon payment owed by the issuer to a ...

How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value). For example, if you paid $800 for a bond and its current yield is 10%, your coupon payment is .1 * 800 or $80. [7] 3 Calculate the payment by frequency. Coupon Definition - Investopedia Coupon rate or nominal yield = annual payments ÷ face value of the bond Current yield = annual payments ÷ market value of the bond The current yield is used to calculate other metrics, such as the... How to Calculate a Coupon Payment | Sapling In finance, a coupon payment represents the interest that's paid on a fixed-income security such as a bond. Par value is the face value of a bond. Calculate the annual coupon rate by figuring the annual coupon payment, dividing this amount by the par value and multiplying by 100 percent. How to Calculate Coupon Rate in Excel (3 Ideal Examples) 2. Calculate Coupon Rate with Monthly Interest in Excel. In the following example, we will calculate the coupon rate with monthly interest in Excel. This is pretty much the same as the previous example but with a basic change. Monthly interest means you need to pay the interest amount each month in a year. So, the number of payments becomes 12 ...

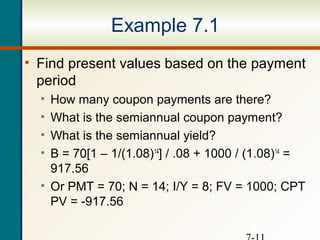

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM). Loan Payment Coupon Book Alternatives - The Balance Your payment coupons just need some basic information to make sure that your payment gets credited properly. Make sure the following items are included in your coupon: Your name and address Your contact information (especially a phone number to call if there are any questions about your payment) Your account number with the lender How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In Excel, enter the coupon payment in cell A1. In cell A2, enter the number of coupon payments you receive each year. If the bond pays interest once a year, enter 1. If you receive payments... How to Get Coupons in 2022 (11 Best Ways) - The Coupon Project If you're asking yourself where to find coupons, there's good news - they are everywhere! Table of Contents Where Can I Get Coupons? 1. Sunday Newspaper 2. Weekly Grocery Store Ads 3. Online Printable Coupons 4. Digital Coupons 5. Coupon Apps 6. At the Store 7. Social Media 8. Mailing Lists 9. Inside Products and Packages 10. Magazines 11.

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ...

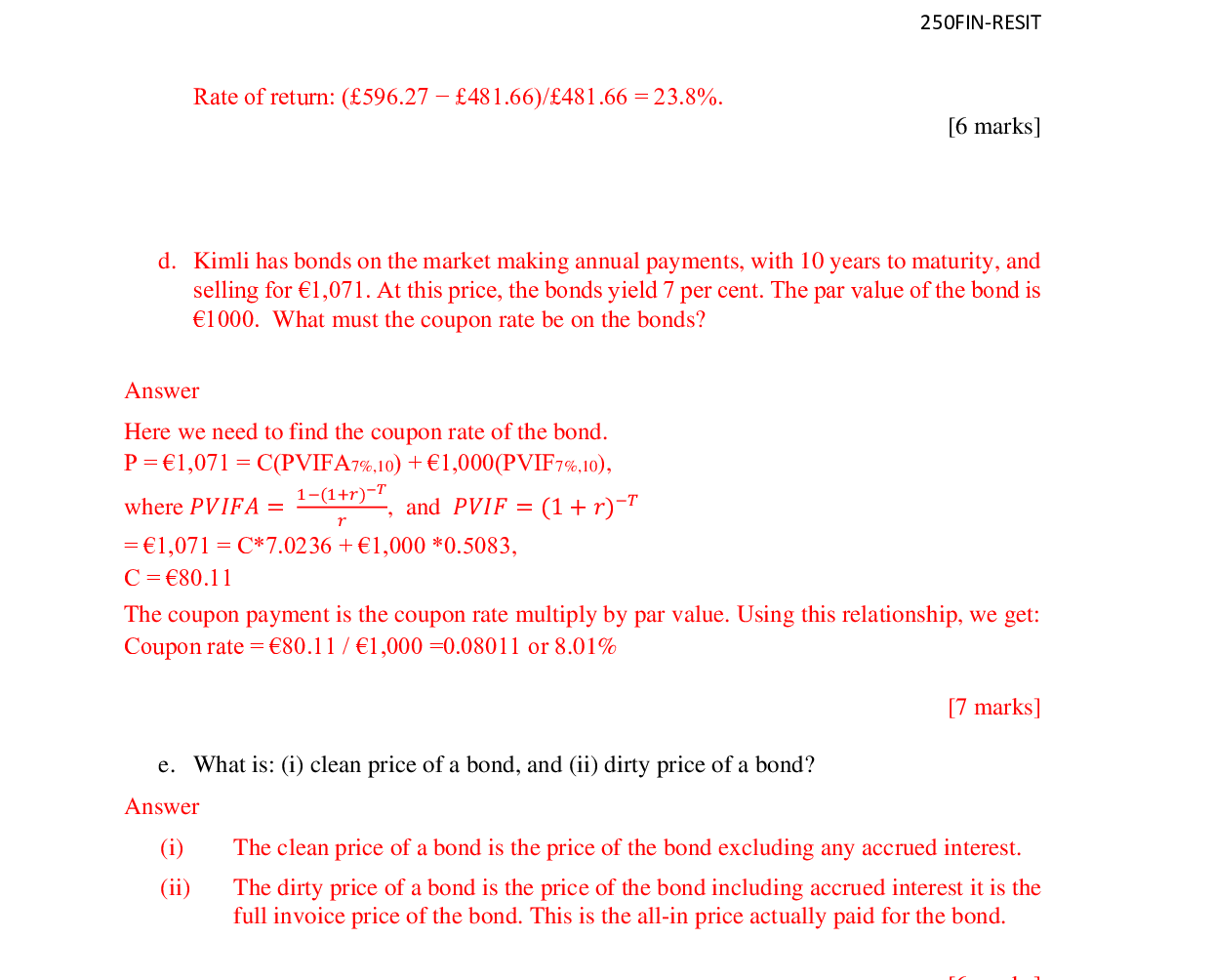

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link

Coupon Bond Formula | Examples with Excel Template - EDUCBA The coupon payment is the product of the coupon rate and the par value of the bond. It also does not change over the course of the bond tenure. The annual coupon payment is denoted by C and mathematically represented as shown below. C = Annual Coupon Rate * F

Coupon Rate Formula & Calculation - Study.com Calculate the annualized coupon payments by summing all the periodic payments made during a given year. Divide the annualized coupon payments by the par value. Convert the resulted coupon rate to...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

Walmart Coupons: How to Find and Use Them - NerdWallet Walmart compiles manufacturer coupons on its website, so check there first. To narrow down your search, use the online store finder to search by ZIP code and select a location near you. "Walmart ...

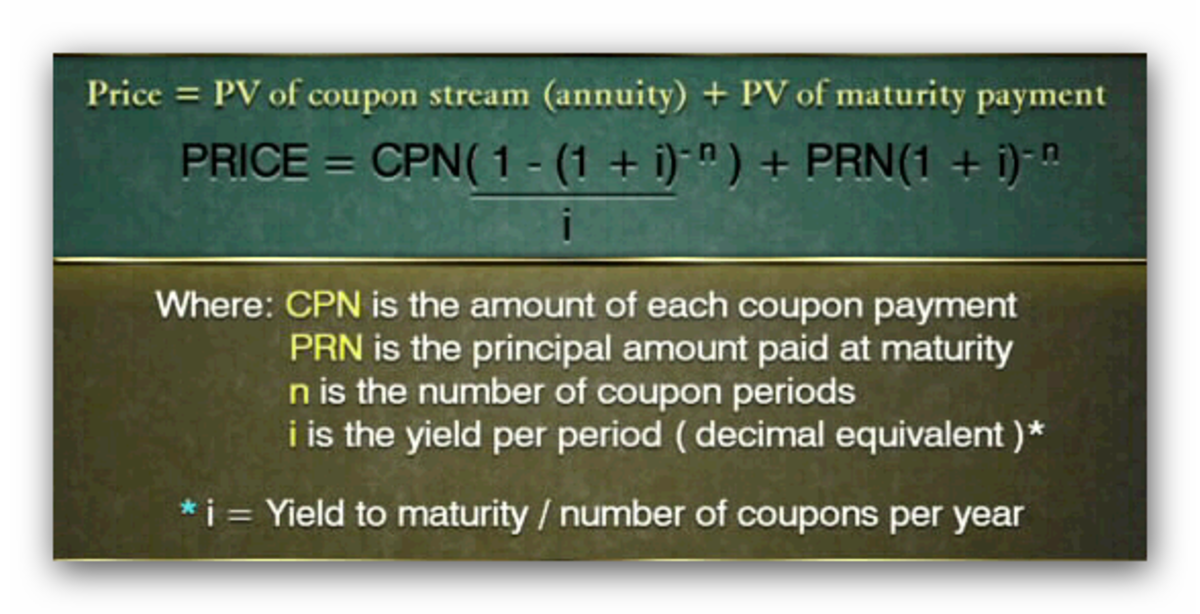

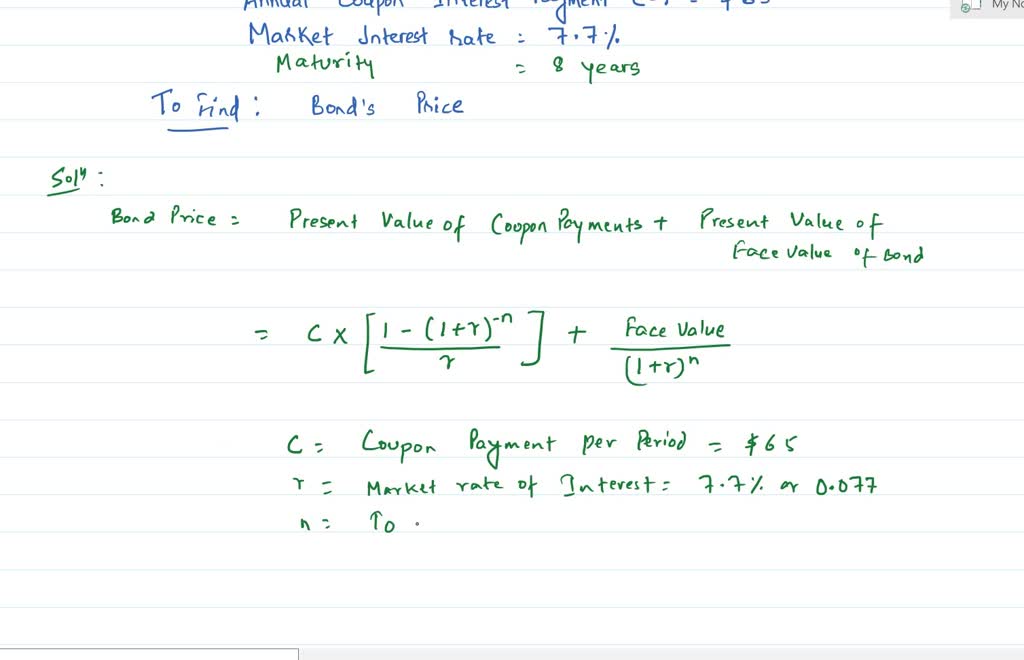

How to Calculate the Price of Coupon Bond? - WallStreetMojo The coupon payment is denoted by C, and it is calculated as C = Coupon rate * P / Frequency of coupon payment Next, determine the total number of periods till maturity by multiplying the frequency of the coupon payments during a year and the number of years till maturity.

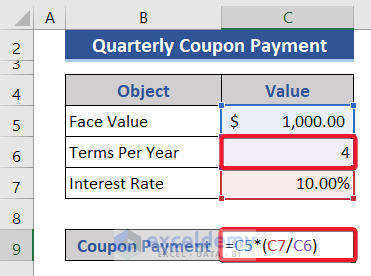

Coupon Payment Calculator You can quickly calculate the coupon payment for each payment period using the coupon payment formula: Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50

Solved a. What is the difference between coupon rate and - Chegg This bond pays semi-annual coupon at an annual. Question: a. What is the difference between coupon rate and yield to maturity? How do you use the coupon rate to calculate the periodic payment received from a bond? b. What is the price of a bond that is currently trading at a yield of 10% and has a face value of $1,000? This bond still has ...

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated by dividing Annual Coupon Payment by Face Value of Bond, the result is expressed in percentage form. The formula for Coupon Rate - Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Below are the steps to calculate the Coupon Rate of a bond:

Coupon Payment | Investor.gov Coupon Payment The dollar amount of interest paid to an investor. The amount is calculated by multiplying the interest of the bond by its face value.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

How to Calculate the Price of a Bond With Semiannual Coupon Interest ... Multiplying the results by the eight coupon payments and the one final face-value payment discounts them to $24.27, $23.56, $22.88, $22.21, $21.57, $20.94, $20.33, $19.74 and $789.41, respectively. Summing and Pricing. Add the results of the previous calculations to achieve a total present value. Concluding the example, adding the present ...

Coupon Barcode Decoding - Understanding Barcodes on Coupons For example, if dd=50, the coupon is for 50 cents off. There are a few exceptions. 01 - free. 14 - b1g1 free. 16 - b2g1 free. 19 - b3g1 free. 02 - b4g1 free. If you still aren't sure how to decode or you have a more complicated coupon, then look for a coupon barcode decoder. You can find out which products apply to certain coupons.

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

![Solved] Jimmy has a bond with a $1,000 face value and a ...](https://www.cliffsnotes.com/tutors-problems/assets/img/attachments/17029158.jpg)

:max_bytes(150000):strip_icc()/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "41 how to find the coupon payment"