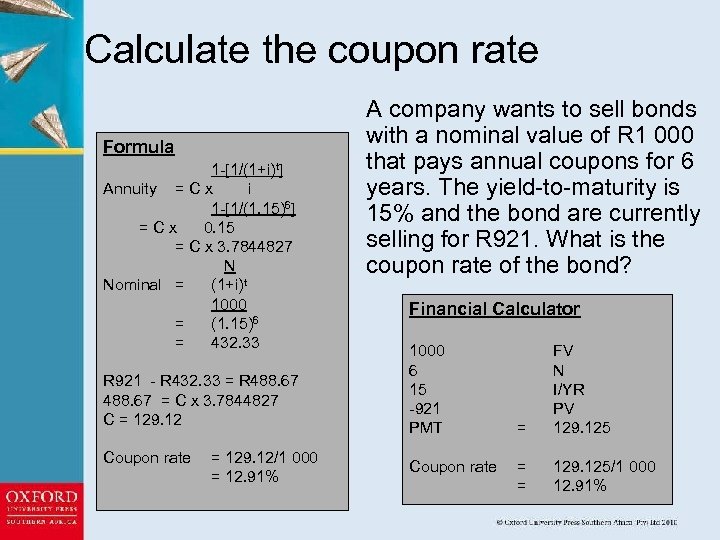

43 formula for coupon rate

Calculate the Coupon Rate of a Bond - YouTube This video explains how to calculate the coupon rate of a bond when you are given all of the other terms (price, maturity, par value, and YTM) with the bond ... Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated by dividing Annual Coupon Payment by Face Value of Bond, the result is expressed in percentage form. The formula for Coupon Rate –.

Coupon Rate: Formula and Bond Yield Calculator - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond. For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000.

Formula for coupon rate

Coupon Rate Formula & Calculation - Video & Lesson Transcript 8 Apr 2022 — Coupon Rate Formula · Identify the par value of the bond. · Identify the frequency of periodic payments (or coupon payments) that have been made. Coupon Rate - Meaning, Calculation and Importance - Scripbox Coupon Rate = (Total Annual Interest Payments / Face Value of the Bond) * 100, Let's understand couponrate calculation with the help of an example. Suppose Company A issues a bond at face value INR 500. The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Formula for Calculating the Coupon Rate, Where: C = Coupon rate, i = Annualized interest, P = Par value, or principal amount, of the bond, Download the Free Template, Enter your name and email in the form below and download the free template now! How the Coupon Rate Affects the Price of a Bond, All types of bonds pay interest to the bondholder.

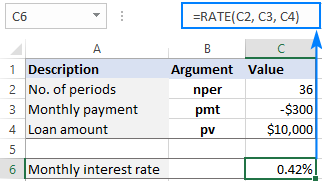

Formula for coupon rate. What Is a Coupon Rate? - Investment Firms How Do You Calculate the Coupon Rate? Let's take a look at the formula for calculating the coupon rate and how we can apply them. Simple Formula, C = I/P, Where: C = coupon rate, I = annualized interest, P = par value, The coupon rate is the rate by which the bond issuer pays the bondholder. How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a... Difference Between Coupon Rate and Discount Rate The security with lower coupon rates will significantly reduce esteem when the Discount rate rises. If the financial backer buys an obligation of 10 years, of the assumed worth of $1,000, and a coupon pace of 10%, then, at that point, the bond buyer gets $100 consistently as coupon installments on the bond. What Is Coupon Rate and How Do You Calculate It? - SmartAsset The coupon rate is calculated by adding up the total amount of annual payments made by a bond, then dividing that by the face value (or "par value") of the bond. For example: ABC Corp. releases a bond worth $1,000 at issue. Every six months it pays the holder $50. To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value:

Coupon Rate - What it is, Formula, & Example - Speck & Company A coupon rate is the percentage value of that cash payment relative to the face value of the bond. For example, say we had a bond with a face value of $1,000 and it paid us an annual coupon of $25. The coupon for this bond would be $25/year while the coupon rate would be $25/$1,000 or 2.5%. The coupon rate is the percentage value. Coupon Bond Formula | How to Calculate the Price of Coupon Bond? It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more. Example #2. Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Difference Between Coupon Rate and Required Return Main Differences Between Coupon Rate and Required Return. Coupon Rate is the periodical price that the buyer receives until the bond matures. Required Return is the amount paid for the investor to own the risks. The coupon rate is calculated using the formula Coupon rate = ( Total annual payment/par value of bond) * 100. Coupon Rate Formula | Simple-Accounting.org A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value.As a simple example, consider a zero coupon bond with a face, or par, value of $1200, and a maturity of one year.

What Is the Coupon Rate of a Bond? - The Balance The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. Bondholders will receive $30 in interest payments each year ... How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow If you know the face value of the bond and its coupon rate, you can calculate the annual coupon payment by multiplying the coupon rate times the bond's face value. For example, if the coupon rate is 8% and the bond's face value is $1,000, then the annual coupon payment is .08 * 1000 or $80. [6] 2, Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Formula: Coupon Rate = (Coupon Payment × No of Payment) / Face Value. What is 'Coupon Rate' - The Economic Times Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ...

Coupon Bond Formula | Examples with Excel Template - EDUCBA Mathematically, the formula for coupon bond is represented as, Coupon Bond = ∑ [ (C/n) / (1+Y/n)i] + [ F/ (1+Y/n)n*t] or, Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] where, C = Annual Coupon Payment, F = Par Value at Maturity, Y = Yield to Maturity, n = Number of Payments Per Year, t = Number of Years Until Maturity,

Coupon Rate Structure of Bonds — Valuation Academy The zero-coupon bonds are sold at a substantial discount to par value. 3) Floating Rate Bonds have coupon rates that vary based on market interest rate or specific index (we call it reference rate) over the life of the bonds. The common formula to calculate the coupon rate is: new coupon rate = reference rate ± quoted margin.

Coupon Payment | Definition, Formula, Calculator & Example The coupon payment on each of these bonds is $32.5 [=$1,000 × 6.5% ÷ 2]. This means that Walmart Stores Inc. pays $32.5 after each six months to bondholders. Please note that coupon payments are calculated based on the stated interest rate (also called nominal yield) rather than the yield to maturity or the current yield.

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

Bond Yield: Formula and Calculator - Wall Street Prep Bond Coupon Rate Formula. The coupon rate can be calculated by dividing the annual coupon payment by the bond's par value. Coupon Rate = Coupon / Bond Par Value; For example, given a $1,000 par value and bondholder entitled to receive $50 per year, the coupon rate is 5%. Coupon Rate = $50 / $1,000; Coupon Rate = 5%

What is the Coupon Rate? - Realonomics The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond.Coupon rates are fixed when the government or company issues the bond. The coupon rate is the yearly amount of interest that will be paid based on the face or par value of the security.

Coupon Rate: Definition, Formula & Calculation - Study.com Coupon Rate Formula. The formula for coupon rate is as follows: C = i / p . where: C = coupon rate ; i = annualized interest (or coupon) p = par value of bond ; Coupon Rate Calculation Example

Coupon Payment Calculator You can quickly calculate the coupon payment for each payment period using the coupon payment formula: Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50,

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%

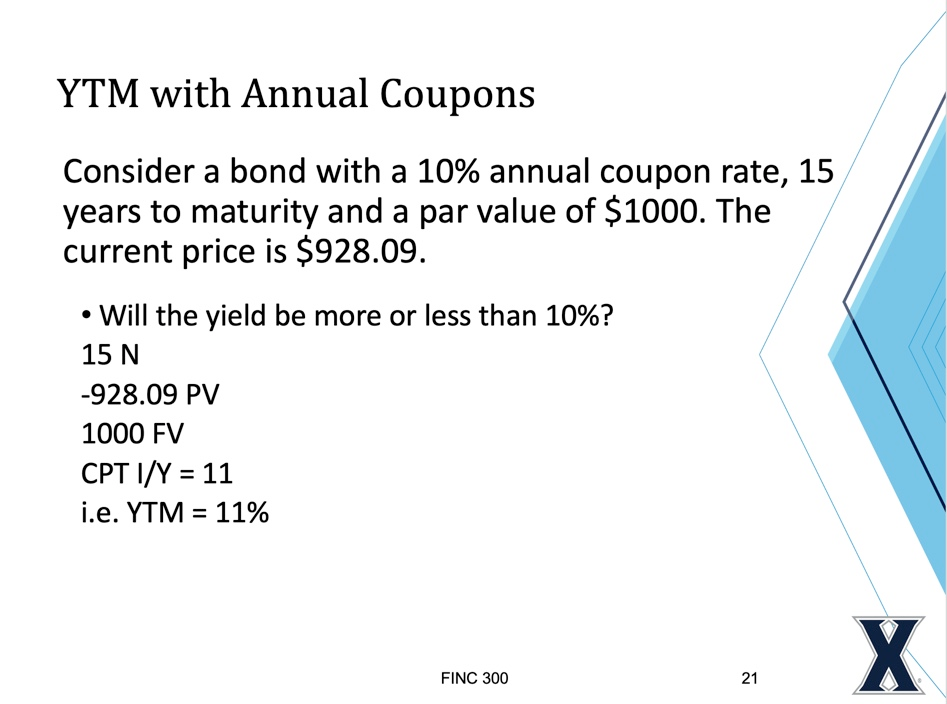

Yield to Maturity (YTM) - Overview, Formula, and Importance The formula's purpose is to determine the yield of a bond (or other fixed-asset security) according to its most recent market price. ... On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Formula for Calculating the Coupon Rate, Where: C = Coupon rate, i = Annualized interest, P = Par value, or principal amount, of the bond, Download the Free Template, Enter your name and email in the form below and download the free template now! How the Coupon Rate Affects the Price of a Bond, All types of bonds pay interest to the bondholder.

Coupon Rate - Meaning, Calculation and Importance - Scripbox Coupon Rate = (Total Annual Interest Payments / Face Value of the Bond) * 100, Let's understand couponrate calculation with the help of an example. Suppose Company A issues a bond at face value INR 500. The coupon payments are semi-annual, and the semi-annual payments are INR 50 each.

Coupon Rate Formula & Calculation - Video & Lesson Transcript 8 Apr 2022 — Coupon Rate Formula · Identify the par value of the bond. · Identify the frequency of periodic payments (or coupon payments) that have been made.

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "43 formula for coupon rate"