41 zero coupon bonds tax

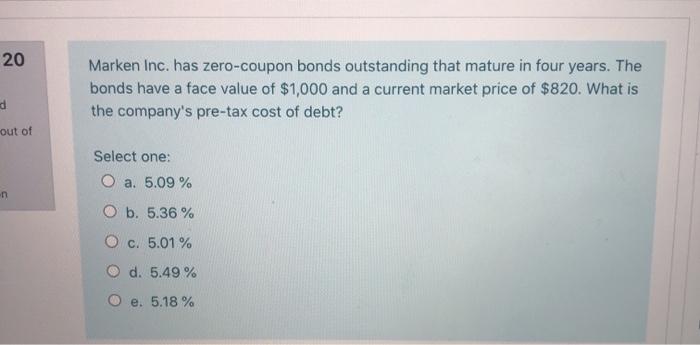

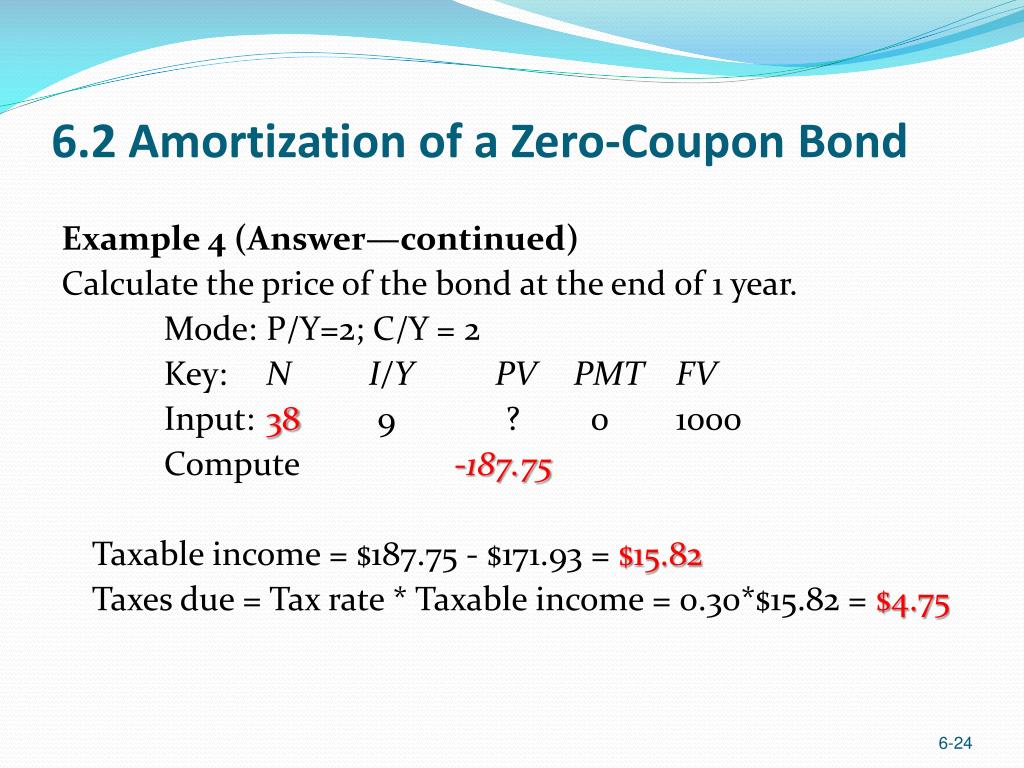

Zero Coupon Bonds: Know tax rules when such a bond is held ... Sep 22, 2022 · The tax rules change, depending on the holding period, amount of gains or loss. In bond terms, coupon rate means the rate of interest offered on a bond. As the coupon rate of a zero coupon bond is ... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon U.S. Treasury bonds have a poor risk-return profile when held alone. Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run ...

The One-Minute Guide to Zero Coupon Bonds | FINRA.org After 20 years, the issuer of the bond pays you $10,000. For this reason, zero-coupon bonds are often purchased to meet a future expense such as college costs or an anticipated expenditure in retirement. Federal agencies, municipalities, financial institutions and corporations issue zero-coupon bonds.

Zero coupon bonds tax

HM Treasury - GOV.UK HM Treasury is the government’s economic and finance ministry, maintaining control over public spending, setting the direction of the UK’s economic policy and working to achieve strong and ... Zero-coupon bond - Wikipedia Therefore, zero coupon bonds subject to US taxation should generally be held in tax-deferred retirement accounts, to avoid taxes being paid on future income. Alternatively, when a zero coupon bond issued by a US state or local government entity is purchased, the imputed interest is free of U.S. federal taxes and, in most cases, state and local ... Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten ...

Zero coupon bonds tax. How to Calculate Yield to Maturity of a Zero-Coupon Bond Sep 23, 2022 · Zero-coupon bonds do not pay interest at regular intervals. Instead, z-bonds are issued at a discount and mature to their face value. ... The IRS mandates a zero-coupon bondholder owes income tax ... Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten ... Zero-coupon bond - Wikipedia Therefore, zero coupon bonds subject to US taxation should generally be held in tax-deferred retirement accounts, to avoid taxes being paid on future income. Alternatively, when a zero coupon bond issued by a US state or local government entity is purchased, the imputed interest is free of U.S. federal taxes and, in most cases, state and local ... HM Treasury - GOV.UK HM Treasury is the government’s economic and finance ministry, maintaining control over public spending, setting the direction of the UK’s economic policy and working to achieve strong and ...

Post a Comment for "41 zero coupon bonds tax"